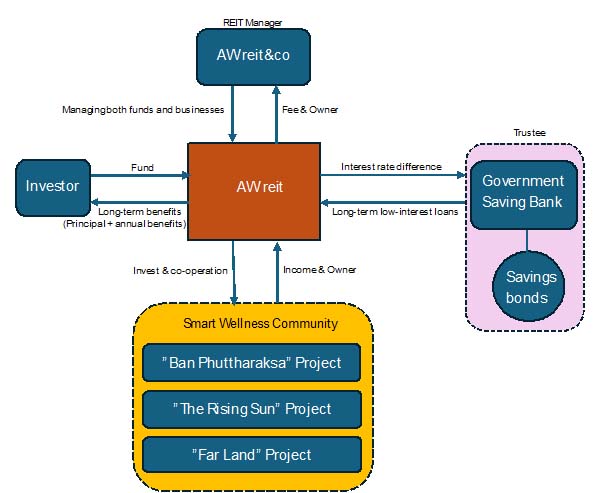

Trust structure

AWreit = REIT Buy-Back

AWreit is a real estate investment trust (REIT with buy-back condition), combining real estate investment with yields similar to those of bonds.

AWreit Structure

1.Trust Form (REIT Buy-Back)

- AWreit is a specially designed Real Estate Investment Trust (REIT) with the condition of returning the principal to investors at maturity, along with dividend payments along the way.

- Investors own 100% of the REIT, while the project uses the REIT's funds to develop buildings or businesses that generate stable income.

- Funding: AWreit raises funds from investors by issuing investment units.

- Investment: The funds raised are used to purchase real estate from real estate developers. At a discounted price.

- Buy-Back Agreement: A contract or agreement that clearly states that the real estate developer has the right or obligation to repurchase the property from AWreit within a pre-agreed period and price.

- Income: During the period of no repurchase, AWreit will earn rental income from the property it holds, which will be paid as dividends to unitholders.

2.Fund flow and returns

- Investors → Invest in the trust → The trust holds the rights to the property (e.g., building/project)

- Operating income → Returns to the trust → Pays regular dividends to investors every 6 months

- When the contract expires (e.g., 13 years), the trust will buy back the entire principal to the investors.

3.Buy-Back Mechanism

- At the expiration of the contract period (e.g., 13 years),

- The trust returns the principal to investors in full.

- Investors therefore receive both interim dividends and a return of principal at the end of the contract period.

Benefits for Investors

Investing in AWreit has unique features that set it apart from other REITs and are attractive to investors seeking stability:

- Principal Stability: The investment is fully repaid upon maturity.

- Predictable Returns: Since this investment has a fixed price and repurchase period, investors can predict the return and the timeframe for which the principal will be repaid, similar to investing in bonds with clearly defined collateral.

- Lower Risk: The value of investment units is less volatile than typical REITs, whose prices are based on the market value of the real estate. Because the previous owner is waiting to buy it back at the agreed-upon price.

- Stable Income Source: Investors will receive dividend income plus a full return of their principal at the end.